Response to Aristocratic Dog

I originally intened to write a normal note refuting your points. However, I believe our discussion to go beyond simple exchange and so I decided to create a longform post instead. Also, unfortunately for you, I'm European and Socialist.

I’m gonna address just one of Einstein’s (and yours, by extension) points: profit motive being the cause of depressions. Dropping a million “why this and why that?” is outside the scope of what could be answered in a note. Gish-galloping doesn’t prove you right and it is a logical fallacy that only dimwits fall for. You haven’t proved anything. I will not allow you to engage in sophistry. You will be blocked if you keep arguing in bad faith.

There's no gish-galloping here. I have addressed your points and asked you for basic explanations on these. Your resorting to call me arguing in bad faith is a collapse to the imaginary. Same thing goes for saying I proved nothing and that I'm engaging in sophistry. If you don't understand what that means, you can ask ChatGPT. I would also remind you that you got the definition and political structure of National Socialism wrong and cited the works of Reisman, which were refuted by Dave Harvey, Richard Wolff, Ian Kershaw and Richard Evans. Even in a another Note you mentioned mixed economics which doesn't align with Reisman's ideology.

The cause of depressions, or business cycles as they are more commonly known, is not because of profits in our modern economies. Interest rates and FIAT money are key.

Interest rates and FIAT money have a MOTIVE to make profit. You're misrepresenting my previous point again. I never argued against profit, I argued against profit over need.

The central banks, like the Federal Reserve, set interest rates lower than the market would, causing currency creation. This new currency is burrowed into the economy. Low rates and government policies direct funds into areas they would not otherwise be. Therefore, the economy experiences an artificial “boom” as expanding companies hire.

Interest rates rise as everyone grasps for the few resources and savings that are actually available. The economy, hence, turns into a “bust” as it is revealed the demand was based on inflation, but not on savings. Then, the cycle repeats itself, with the Fed printing more money, giving it to the stock market, and setting interest rates lower than the market would.with hard money, these business cycles would be impossible.

I will use the depression in 2009 as evidence for this. The standard story is that greedy investment bankers and mortgage brokers caused the crisis. The real causes are much in a similar vein as already explained. In 1977, the Community Reinvestment Act was passed in the US. This federal law forced banks to lower interest rates for people they normally wouldn’t lend to, for those “in need”. This decrease in the requirements for getting loans led to a an uptake in subprime mortgages, as the law forced banks to set up quotas of loans to minorities.

You're assuming a mythical "market-determined" interest rate free from institutional influence. In reality, all modern economies operate with central banks; there's no "neutral" baseline for comparison. The Fed cut rates near zero in 2020 to prevent a depression amid lockdowns which is a response to crisis, not artificial boom-creation. The central banks are tools for the elite to manage crisis inherent to capitalism. Low interest rates and QE are emergency measures to protect profits, not distortions of a "natural" market. They bail out banks and corporations during crisis (2008, 2020) and they maintain the exploitative wage-labor system by preventing mass--unemployment from triggering revolts. Booms under capitalism are always built on exploitation of labor, overproduction and ficticious capital. Central bank policies merely postpone inevitable crisis, they don't cause artificiality. The entire system is artificial and unstable.

Lenders had to do all sorts of tricks and financial buffoonery for this law. For example, they would give loans without interest for the first 20 months to people who had an atrocious credit. I can’t make it up. Additionally, land use restrictions raised prices in places like coastal California, something those who live there still suffer with—exorbitant housing costs abounding.

Fannie Mac and Freddie Mac, government sponsored enterprises (GSE’s), purchased mortgages from lenders, socializing the risk associated with this uber-high-risk loans. This further on encouraged lenders to make riskier loans because these GSE’s would buy them.

Predatory lending was driven by profit, not regulations. "Teaser rates" and NINJA loans were profit driven innovations by private lenders (e.g Countrywide, New Country) securitizing loans for Wall Street. The 1999 Gramm-Leach-Bliley Act repealed Glass-Steagall, allowing banks to emerge with insurers/investment firms and fuel high-risk securitization. Only 6% of high cost loans were CRA-related. Non-CRA-regulated lenders issued 5x more subprime loans than CRA banks. Fannie/Freddie followed the Market, not led it. Private lenders like Lehman Bros. dominated subprime until 2005. GSEs followed to compete, just buying 25% of subprime MBS at peak (FCIC report). GSE's average loan had a 720 FICO score vs 615 for private label securities. GSEs were privately owned until 2008 conservatorship. Executives pushed risk to meet Wall Street profit targets.

If you're gonna blame someone, blame NYMBY's, not socialism. The Coastal California's housing crisis stems from local control like environmental reviews (CEQA) which are weaponized to block housing or Single- family -zoning (created by local ordinances) which covers 75% of L.A and 80% of S.F.

The Bubble was global, not just U.S Policy driven. Ireland, Spain and the UK (with no CRA/GSEs) had worse housing bubbles!

The U.S suffers from a housing shortage of 3.8 million units (up for growth). The real solution is public investment in social housing (vienna's model) which reduces market pressure unlike the 2000's subsidies for speculation.

As outlined at the beginning, this artificial “boom” was caused by lower interest rates and inflation. These people with bad credit, unsurprisingly, couldn’t pay their mortgages en masse, leading to a “bust”. Of course, what did the Fed do to “remedy” this situation? Lower interest rates, print money, and give it to the stock market. The business cycle repeating itself.

Politicians had every incentive to force lenders to give houses to poor minorities, it allowed them to get re-elected in the short run. There is much political mileage to be gained and no political or economic price to be paid by the failures that follow.

The 2008 crash was not caused by "government distortions" but by capitalism's inherent contradictions which were exploited ruthlessly by finance capital. Industrial capitalism's stagnation (since the 70's) pushed capital into ficticious markets, like subprime mortgages, to sustain accumulation. Predatory lending targeted Black/Latino communities not because of "political correctness" but because redlining had already concentrated poverty there, creating a resevoir for super-exploitable labor.

The subprime crisis was a case of capital 'discovering' new territories when old ones dried up.

- Dave Harvey, The Enigma of Capital

Fannie Mae and Freddie Mac were not "socialist" entities but state-backed monopolies that socialized risk for private profit. Their collapse revealed capital's dependence on the state to absorb losses. The post-crash bailouts ($16T in Fed loans to banks) exposed the state's true role: protecting ruling-class property while imposing austerity on workers.

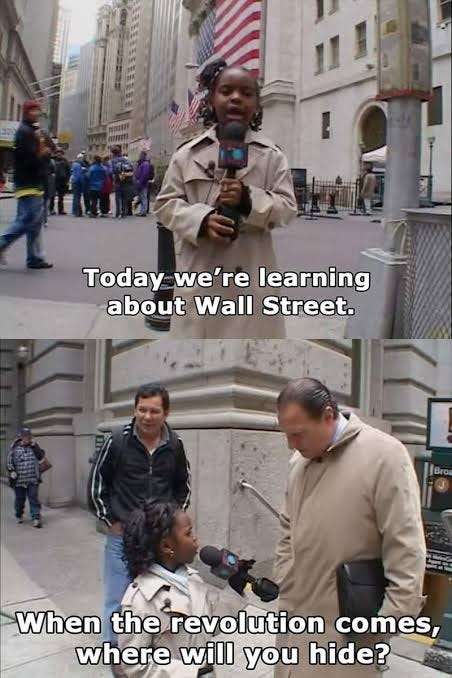

Claims of "forcing banks to lend to minorities" are ideological smokescreens. In reality, both parties deregulated finance (Clinton repealed Glass-Steagall; Bush pushed 'ownership society). Minorities were sacrificial lambs for Wall Street's securitization machine. Bourgeois democracy offers only the illusion of choice. Politicians gain "mileage" by channeling rage away from capital. Lowering rates and printing money inflated asset prices, enriching the top 10% and cutting the wages of workers. That was always the goal.

That’s one point. Look at how much I had to write to prove you wrong. But well, I’m sure that some will fall for your gish-gallop slop.

But you didn't prove anything. I adressed all of your points with clear language and you blamed socialism for policies created by a capitalist state and told me I'm "arguing in bad faith". If you want a debate on one specific claim, I'm ready. No wall of text needed. But if your goal is to dismiss systemic analysis as "slop", we'll have a different conversation. Your call.